Blog

Navigating Increasing Mortgage Rates: How to Secure a Cheaper Deal in the UK

In the United Kingdom, homeowners who have been enjoying the stability of a fixed-rate mortgage are now facing a common predicament - the end of their fixed-rate term. When a fixed-rate mortgage matures, borrowers often find themselves confronted with the prospect of...

What is the Support for Mortgage Interest (SMI) Scheme?

The government offers Support for Mortgage Interest (SMI), a loan intended to assist in making interest payments on your mortgage or home improvement loan. This article explains how SMI works, who is eligible, and how to repay the loan, as well as providing...

Mortgage Lending Criteria

Getting a mortgage in the UK can be a daunting task, as each lender has their own set of eligibility criteria. With over 70 banks, building societies, and specialist mortgage providers in the UK, finding a lender that meets your requirements shouldn't be too...

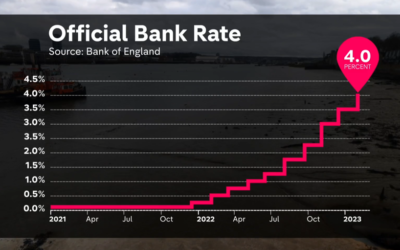

Understanding the Impact of Interest Rate Changes on Your Mortgage Payment

If you're a homeowner with a mortgage, you're likely aware that changes in interest rates can affect your monthly payments. The Bank of England, which sets the base rate for borrowing, recently announced a rise in interest rates from 0.1% to 0.25%, the first increase...