How Interest Rates Affect Mortgage Payments

Interest rates are a crucial component of the mortgage process. When you take out a mortgage, you borrow money from a lender to buy a property, and you agree to pay back that loan plus interest over a set period. The interest rate you’re offered is based on a variety of factors, including your credit score, income, and the amount you’re borrowing. If interest rates rise, your mortgage payments will likely go up too, as more of your monthly payment goes towards paying interest instead of reducing the principal balance.

For example, let’s say you have a £200,000 mortgage with a fixed interest rate of 2%. Your monthly payments would be £898, and over the 25-year term of your mortgage, you’d pay a total of £269,455. However, if the interest rate increased to 2.25%, your monthly payments would rise to £921, and you’d pay a total of £276,237 over the same period. That’s an increase of £6,782, or about 2.5% more than your original total.

How Much Your Mortgage Payment Could Increase

The amount your mortgage payment could increase following an interest rate change depends on several factors. The size of your mortgage, the length of your loan term, and the interest rate you’re currently paying all play a role in determining your monthly payments. Additionally, the type of mortgage you have (fixed-rate, tracker, or variable) will affect how much your payments could go up.

If you have a fixed-rate mortgage, your interest rate is locked in for a set period, typically two to five years. This means that your payments will stay the same during that time, regardless of any changes in the base rate. However, when your fixed-rate period ends, your mortgage will likely switch to a variable rate, which means your payments could go up or down in response to interest rate changes.

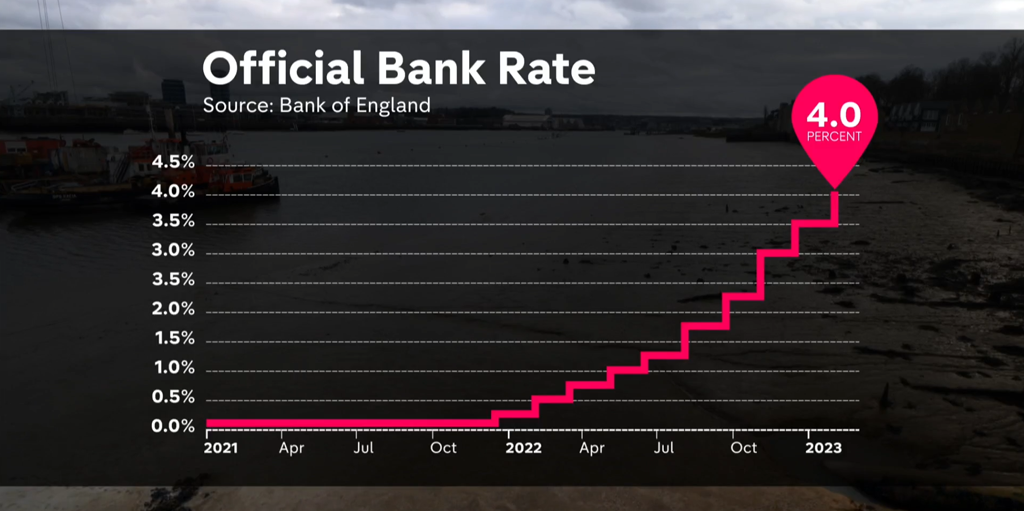

If you have a tracker mortgage, your interest rate is linked to the base rate, and your payments will go up or down in line with any changes. For example, if your tracker rate is set at 1% above the base rate, and the base rate increases from 0.1% to 0.25%, your rate would increase to 1.25%, and your payments would go up accordingly.

If you have a variable rate mortgage, your interest rate can change at any time, and your payments will go up or down accordingly. While variable rate mortgages often come with lower initial rates than fixed-rate mortgages, they can be less predictable, and your payments could change significantly over time.

How to Mitigate the Impact of Interest Rate Changes

If you’re concerned about how much your mortgage payment could go up following an interest rate change, there are several steps you can take to mitigate the impact. One option is to remortgage to a fixed-rate deal, which would give you certainty over your payments for a set period. Alternatively, you could overpay your mortgage each month, which would reduce the amount you owe and could also help you pay off your mortgage faster.

Another option is to speak to your lender about your options. Some lenders may be willing to